flow through entity tax break

However the late filing of 2021 FTE returns will be accepted as timely if filed. Tax purposes for example a disregarded entity or flow-through entity for US.

Elective Pass Through Entity Tax Wolters Kluwer

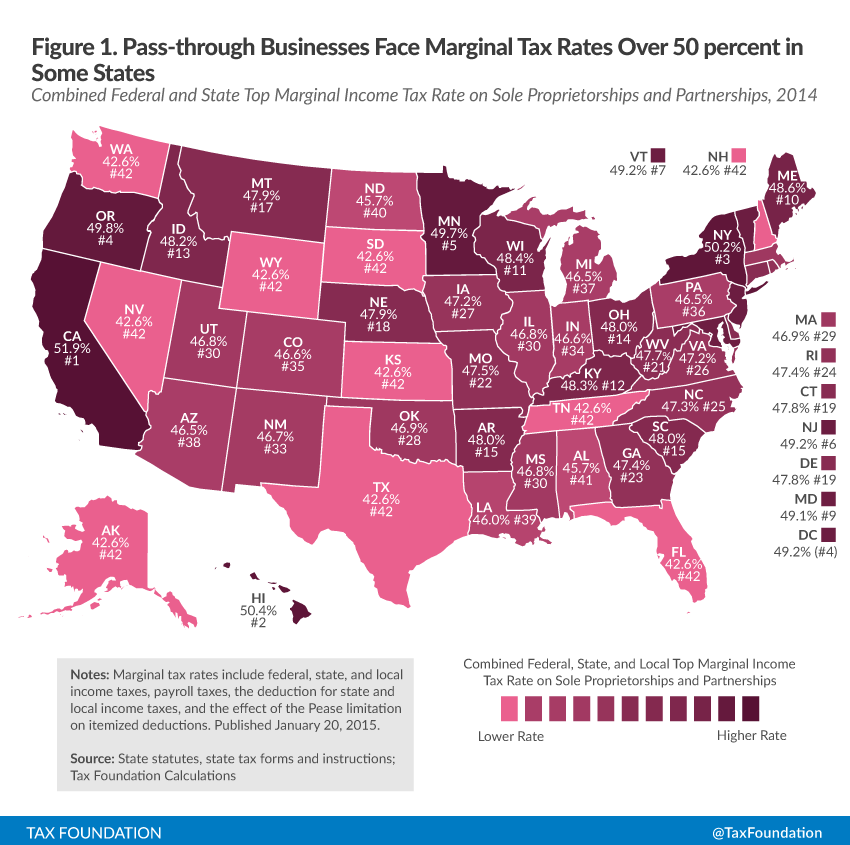

This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the.

. Interest and if applicable penalty will. Most small businessesand quite a few larger onesare set up as pass-through entities. That is the income of the entity is treated as the income of the investors or owners.

20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan. Tax purposes and the entity is or is treated as a resident of a treaty country it will derive the item of income and may be eligible for treaty benefits. Flow-through entities are considered to be pass-through entities.

Advantages of a Flow-Through Entity. Types of flow-through entities. Many small businesses are set up as flow.

Governor Whitmer signed HB. Understanding What a Flow-Through Entity Is. Specifically the law disallowed pass-through owners from using business losses exceeding 250000 to offset non-business income.

There are three main types of flow-through entities. That dollar threshold is for single. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

Effective December 21 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in Michigan allowing certain flow-through entities to elect to. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. There are two major reasons why owners choose a flow-through entity.

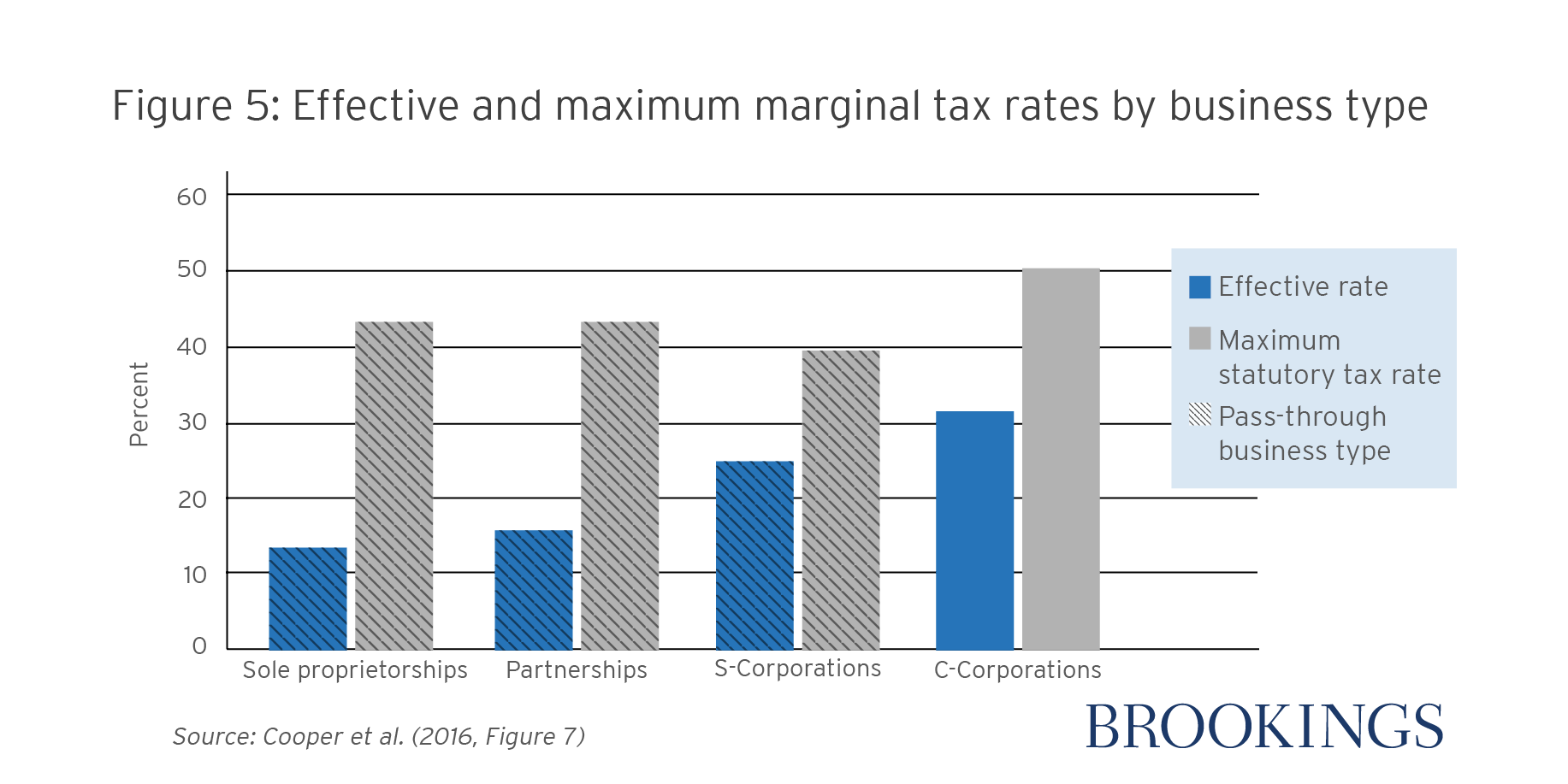

In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. A flow-through entity FTE is a legal entity where income flows through to investors or owners. The entitys income only goes through a.

The law signed by Whitmer on Dec. For purposes of claiming treaty benefits if an entity is fiscally transparent for US. This legislation was passed as a workaround.

A business owned and operated by a single individual. This means that the flow-through entity is responsible. The Tax Cuts and Jobs Act gave temporary tax breaks to individuals.

A flow-through entity must pay by the initial due date of the annual return its estimated unpaid tax liability for the tax year covered by an extension. The pass-through deduction is set to expire after 2025 unless extended by Congress. A flow-through entity is also called a pass-through entity.

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

How A Pass Through Entity Tax Deduction Can Affect An M A Deal Our Insights Plante Moran

Pass Through Entity Tax 101 Baker Tilly

9 Facts About Pass Through Businesses

These States Offer A Workaround For The Salt Deduction Limit

What Are Pass Through Businesses Tax Policy Center

How A Pass Through Entity Tax Deduction Can Affect An M A Deal

What S With This 20 Deduction On Pass Through Income And Will It Help Me Wffa Cpas

Virginia New Mexico Enact Pass Through Entity Elections Forvis

9 Facts About Pass Through Businesses

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Pass Through Entity Definition Examples Advantages Disadvantages

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Impact On Individuals Operating A Business Directly Or Indirectly Through A Pass Through Entity Bracewell Llp

An Overview Of Pass Through Businesses In The United States Tax Foundation

Pass Through Entity Tax Ptet Work Around The Salt Cap And California Business Tax Credits

Optional Pass Through Entity Tax Wolters Kluwer

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal